will child tax credit continue in 2022

As part of a COVID relief bill Democrats increased the tax credit to 3000 per child ages 6-17 and 3600. We dont make judgments or prescribe specific policies.

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit - English Stimulus - English.

. Explore new Tax Foundation modeling of the economic revenue and distributional effects of several child tax credit reform options in 2022 and beyond. Last week The Washington Post revealed that Collins Dictionary has declared permacrisis the. Theres a slim chance.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The Child Tax Credit in 2022 is a powerful tax tool that can help you save on your taxes. How do you qualify for the child tax credit in 2020.

An expanded child tax credit would continue for another year. October 6 2022 809 AM CBS Los Angeles Time is running out to claim. 2 days agoUnder last years American Rescue Plan the maximum Child Tax Credit increased to 3000 or 250 a month for each child aged 6 to 17.

No corporate tax cuts without expanding the child tax credit. 1 day agoIt is estimated that the average tax credit will be 171 but the tax credit that families receive will be income-based. Expanded Child Tax Credit available only through the end of 2022 By Darleene Powells Updated on.

There might not be planned advance child tax credit. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Right now the extra credit is set to begin in July and end in 2022 but on Wednesday Biden said he hopes to extend it at least through the end of 2025 Families who.

The child must have been 16 or. The Child Tax Credit 2022 is now worth up to 2000 per qualifying child and can be. See what makes us different.

Although most Democrats in Washington DC. Pennsylvanians paying for child care services could be eligible. And to 3600 or 300 a month for.

President Biden wants to continue the child tax credit payments in 2022. For those with two. 2021 rules going away.

Support the bill Senator Joe Manchin D-WVa is opposed to continuing the child tax credit in 2022. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The credit increased from 2000 to.

But Things Will Change Again When You File Your 2022 Return As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Child and Dependent Care Credit.

Filers could get up to 50 credit on 8000 in care expenses for one child under age 13 or an incapacitated spouse. For households with one child the income is 600. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Enhanced child tax credit. In fact he wants to try to make those payments last for years to come all the way through 2025. So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6 and 250 per child per.

The child tax credit expansion increased the amount of money families can receive per child and expanded who can receive the payments. This means that the credit will revert to the previous amounts. 1200 sent in April 2020.

38 related questions found. Will monthly child tax credit payments continue into 2022. The FSA 20 would increase the maximum annual child tax credit from 2000 to 4200 for each child under age 6 and 3000 for each child ages 6 through 17 paid out in.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 1 day agoFor filers who are single or married without children the credit is 300.

Nov 8 2022 601 AM. However that rate rises for families. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022.

1 day agoThe enhanced child tax credit offers up to 3600 per child or up to 1800 per child if you got monthly payments in 2021. The advance is 50 of your child tax credit with the rest claimed on next years return.

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit 2022 Millions Of Americans Set To Score Direct Payments Worth Up To 270 See The Exact Date The Us Sun

Four Reasons The Expanded Child Tax Credit Should Be Permanent Rwjf

Future Child Tax Credit Payments Could Come With Work Requirements

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Widely Supported Child Tax Credit Is Associated With Greater Trust Of Democrats Common Dreams

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Improvements Must Come Before Corporate Tax Breaks Center For American Progress

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

How To Claim Pa S New 2022 Child Tax Credit Spotlight Pa

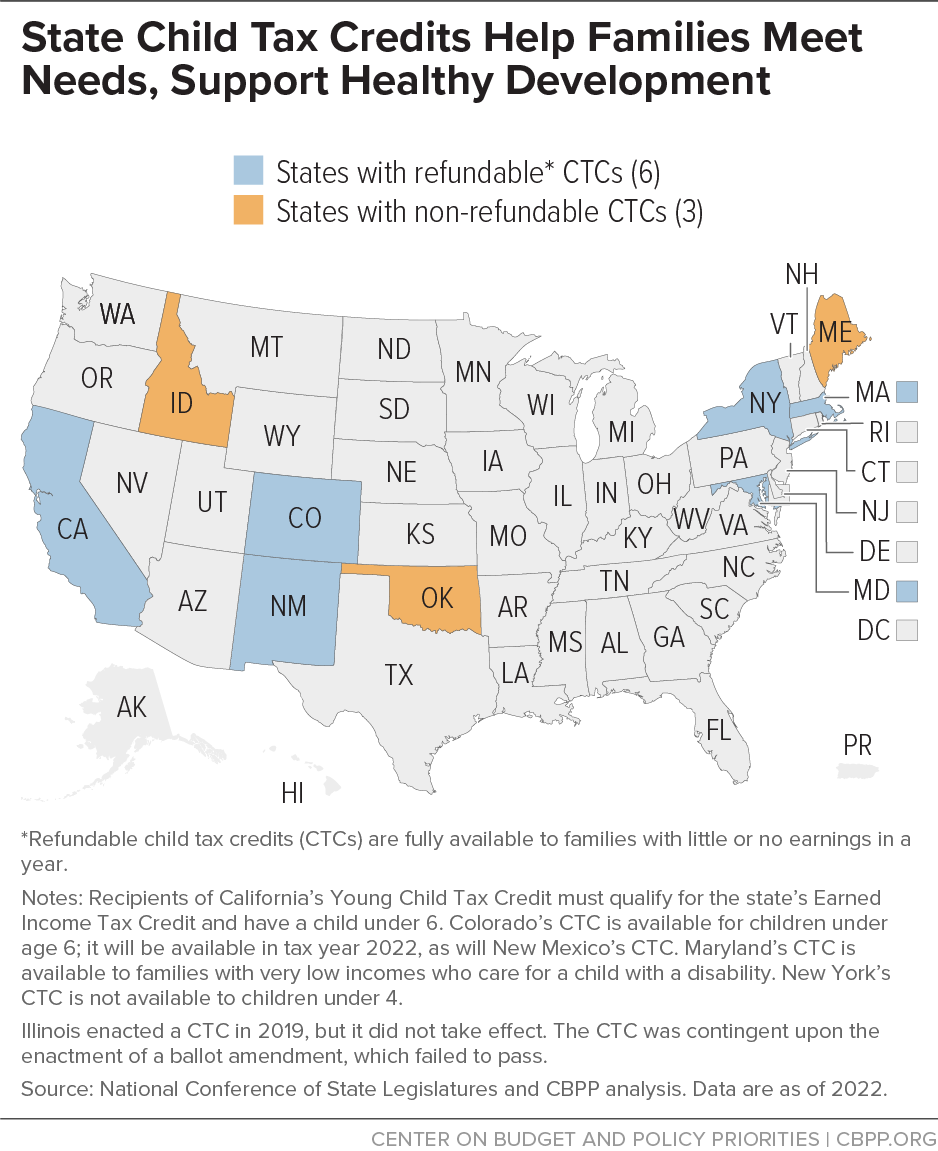

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Stimulus Update Final Child Tax Credit Payment Of The Year Arrives In 1 Week

Child Tax Credit 2022 What We Know So Far

Does The Child Tax Credit Continue In 2022 Must Know For Parents

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services